About the Company

A large U.S. Credit Union providing retail banking products & services

Background of Business Problem

- The Credit Union struggled with significant inefficiencies in its Account Services process due to outdated self-service features that lacked real-time capabilities.

- Customers found it challenging to promptly validate their personal information and account updates, resulting in considerable frustrations and delays.

- These issues not only hampered customer satisfaction but also affected the overall efficiency of the Credit Union's operations, highlighting the urgent need for modern, real-time solutions to enhance the customer experience

Our Approach & Solution

Infinite transformed the Credit Union's operations by leveraging Robotic Process Automation (RPA) with UiPath to digitize and streamline backend processes. This automation significantly reduced manual errors and inefficiencies. By seamlessly integrating automated workflows with front-end channels, Infinite created a unified system offering real-time updates.

This technological enhancement empowered customers with robust selfservice capabilities, enabling instant validation and updates of their information. The result was a vastly improved customer experience, characterized by greater convenience, speed, and satisfaction.

By embracing RPA and integrating it with front-end operations, Infinite not only modernized the Credit Union's processes but also set a new standard for customer service efficiency and effectiveness. This strategic move highlights Infinite's commitment to leveraging advanced technologies to drive superior customer experiences.

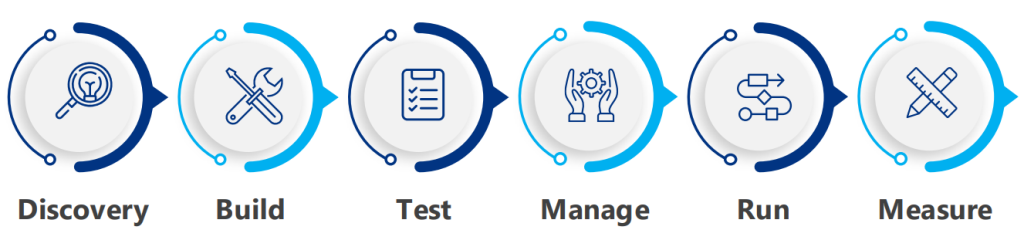

Infinite has proven experience across the RPA life cycle

Business Outcomes

Improved Accuracy and speed of response to self servicing improved Member Experience

Reduced manual effort and saved cost of servicing members.

Integrated operations and process automation streamlined account services, enhancing customer satisfaction

Cost-effective operational model significantly boosted profitability