overview

The Strategic Drivers for Core Banking Migration to Cloud

1. Seamless Integration

Core banking migration to the cloud is a transformative initiative, but its complexity demands meticulous planning, execution, and risk mitigation. Infinite brings industry-leading cloud capabilities, backed by partnerships with AWS, Microsoft Azure, and Google Cloud Platform (GCP), to help financial institutions achieve seamless and efficient transitions.

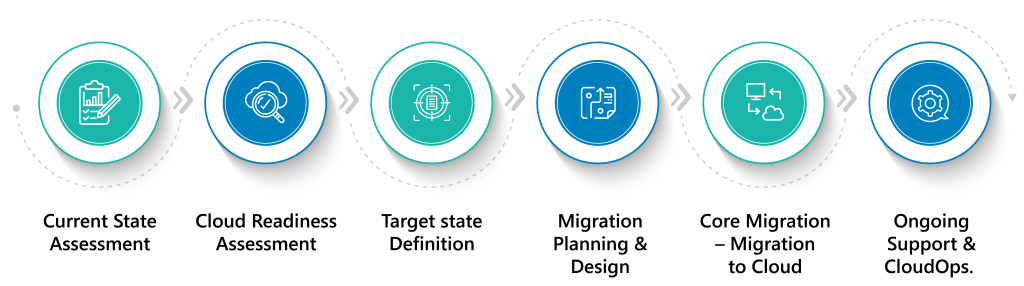

The first step in a successful migration journey is a comprehensive evaluation of a bank’s IT assets, Core Banking, and surround applications. Infinite’s AWS Cloud Assessment and Planning stage identifies interdependencies, evaluates cloud suitability, and develops a detailed migration strategy. This structured approach ensures readiness and minimizes operational risks.

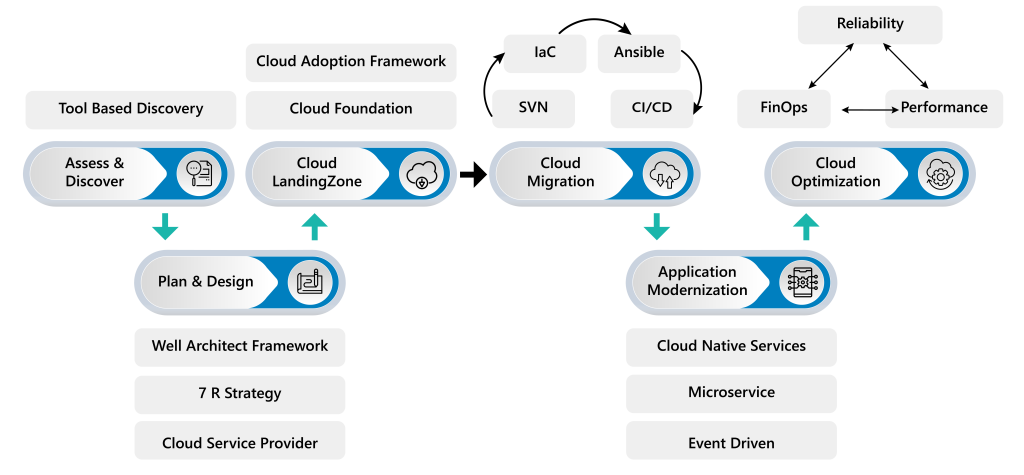

To effectively migrate large-scale Core Banking workloads in an enterprise environment, leveraging hyper-automation or a factory framework model is essential. These methodologies not only enhance scalability and efficiency but also streamline the overall migration process.

Adopting Infrastructure as Code (IaC) tools such as Terraform, AWS CloudFormation, Azure Resource Manager (ARM) templates, and Ansible enables automated provisioning and resource management, reducing the risk of manual errors. Additionally, establishing robust Continuous Integration and Continuous Deployment (CI/CD) pipelines ensures seamless and consistent deployments, facilitating faster iterations and enhanced operational agility.

Success Stories Demonstrating Our Capabilities

Our expertise in Core Banking cloud migrations is backed by proven success across diverse projects for Banks & Credit Unions:

- Architectural Assessments & Designs: We have evaluated and crafted robust architectures for Core Banking solutions, leveraging cloud-native services and APIs to ensure optimal scalability and performance.

- Automated Infrastructure & DevOps Deployments: Our team has built fully automated IaaS provisioning and DevOps pipelines, streamlining deployment processes for faster go-to-market and reduced operational overhead.

- Comprehensive Cloud Migration Strategies: We have meticulously planned and executed cloud migrations across various archetypes, move groups, and clients, ensuring seamless transitions with minimal disruption.

- Factory Model Execution: By leveraging a detailed playbook, we have successfully implemented cloud migrations using a factory model, delivering scalable and repeatable migration solutions.

- End-to-End Core Banking Migrations: Our expertise extends to migrating Core Banking solutions for multiple banks and fintech companies to prominent cloud platforms such as AWS and Azure, driving innovation and operational efficiency.

These success stories highlight our commitment to excellence and our ability to deliver tailored solutions that address the complex needs of modern financial institutions. For further information reach out to us on BFSI@Infinite.com